The Government this week legislated the full suite of income tax cuts, delivering one of the Coalition’s key economic policies included in the 2018–19 Budget.

The first round of tax cuts will take effect on 1 July 2018, although taxpayers will not receive the money until they lodge their tax returns at the end of the 2018–19 financial year.

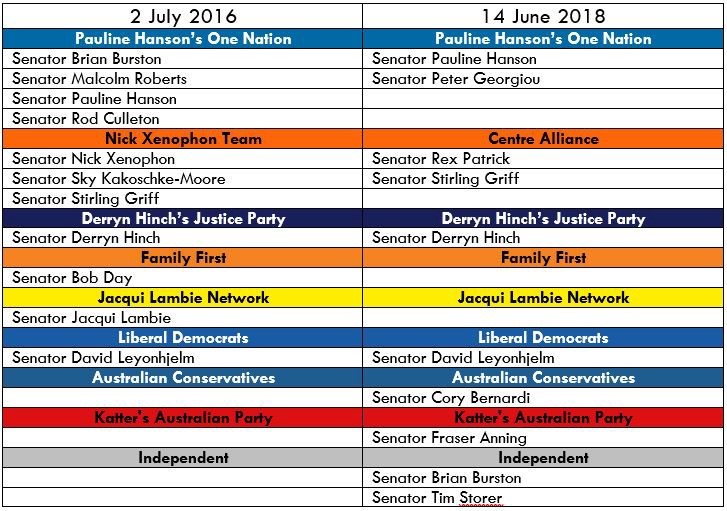

Centre Alliance and Pauline Hanson’s One Nation were the final votes the Coalition needed for the reforms to pass the Senate.

The Centre Alliance has said it would help a future government undo some of the long-term tax cuts included in the plan.

Senator Pauline Hanson has suggested the Coalition could find more money by cracking down on multinational companies not paying their fair share of tax and reviewing the salaries of bureaucrats. This is likely to be a key sticking point for One Nation during the final negotiations on the company tax cuts next week.

All up, the cuts will cost the federal budget $144 billion over the first seven years.

Latest posts by Team Nexus APAC (see all)

- MUCH MORE NEEDED TO CLOSE THE GAP - February 15, 2019

- HAKEEM RETURNS HOME - February 15, 2019

- MEDIVAC BILL - February 15, 2019